As financial planners, we are asked this question in some form on a regular basis. Many times clients are hoping for a hot stock tip, investment or tax strategy that will pad their investment portfolio and spare them the chore of saving diligently. I am going to share with you the secret to early retirement and financial security. It is the closest thing to magic that we have in our financial planning toolboxes:

TIME

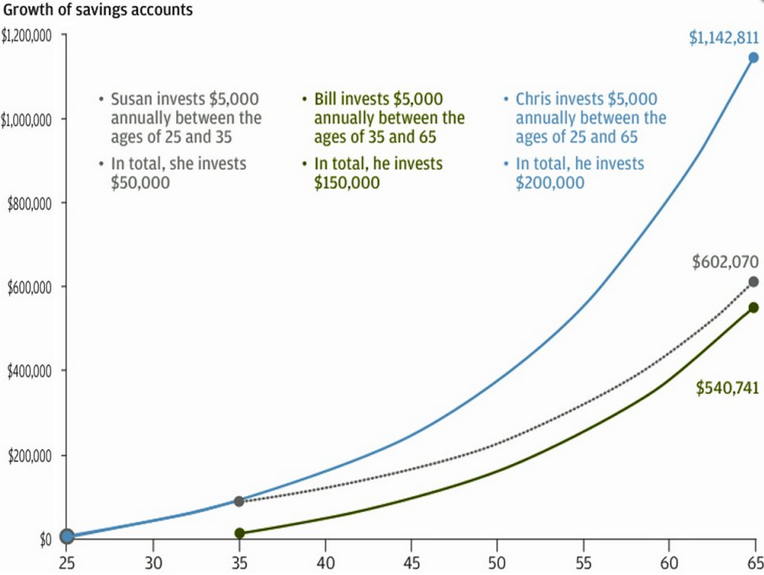

It’s not glamorous, but it is that simple. The earlier you start saving the better your chances of achieving your long term goals. Take the following example from JP Morgan into consideration:

*Assuming 7% annual rate of return

Obviously Chris is the winner here and he benefited from both diligence and starting early, but Susan did pretty well with just 10 years of savings and allowing that money to benefit from compound interest and the time value of money. Bill saved triple the amount that Susan did and still ended up with less money as a result of starting 10 years later.

There are always excuses not to get started early-student loans, high rent, low starting salary, etc. However, the longer you wait the more you will have to save to achieve the same (or lesser) result. There are always trade-offs, so this is one to consider: Would you rather scrimp and get by on a lower take home pay in your 20’s when most of your friends are doing the same thing or would you rather start doing that in your 30’s when you have a mortgage, kids, day care and diapers to pay for? Or in your 40’s and 50’s when college is looming and you are burning out in your career?

When you look at it this way the choice feels simple. If you can start putting away 10-15% of your income in your 20’s you will save yourself a lot of difficult decisions later on in life. If you can make these savings automatic and set your standard of living accordingly, you will never miss those funds that you put away. The longer you wait to get started the harder it is to allocate funds to saving as the demands of life increase.

Of course there are always trade-offs and any good financial plan should aim to create a balance between living for now and saving for later. If you have questions about the best way to achieve your long term goals, please contact us today.