When signing up our daughter for soccer, I immediately began daydreaming about how she would dominate all the other 5 year-olds on the field.

When signing up our daughter for soccer, I immediately began daydreaming about how she would dominate all the other 5 year-olds on the field.

Not sure why my imagination started there, but expectations were sprouting before I knew it. I noticed it at the time and did my best to temper the hall of fame path I’d created for her in my head. But it wasn’t until we stepped on the field that I saw she was much more interested in dancing with her teammates than listening to the coach (as any 4 year old should do, right?). My expectations had been out of line with reality.

This experience reminded me of how often our expectations can get away from us, resulting in decisions with tough consequences.

Think about the last time you felt something surprised you. If it was a pleasant surprise, the event likely exceeded expectations. Then there’s the surprises that catch us off guard. A great example occurs around tax time each year as many people are surprised when they owe a large tax bill. It’s tough to find anyone that would describe that as a positive feeling.

If it stops at feelings, bad outcomes are generally avoided. It’s when events fall short of our expectations where our patience can run thin and our “do something” alarm begins sounding. When this type of decision making is applied to investing, it’s likely you find an average investor.

Who is the Average Investor?

The average investor is best described as a person attempting to time the market intentionally or unintentionally based on emotional influence. By allowing their emotions to rule decision making, selling and buying of investments tends to follow the crowd. This phenomenon is tied to research around the psychology from Daniel Kahneman who found that losses produce twice the mental anguish as an equivalent sized gain.

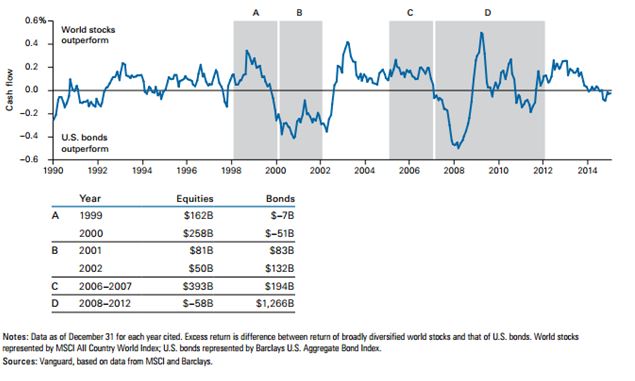

Cash flow data backs this up. Studies show investors have more money invested in funds when they are doing poorly and fewer when they are doing well.

Most of us have either a personal story or a friend or family member experience of getting overly-exuberant in the tech markets of the late 1990’s or buying real estate just before the housing crisis in 2007. The fact is we all have some of the average investor in us, which is why having a disciplined process in place is so important.

Common Behavior of the Average Investor

One of the most common identifiers around an average investor is the desire to chase performance of a hot area.

This plays out by investing in the best performing asset class over the last 12 months or selling all of your stock investments because a financial celebrity predicts a crash ahead.

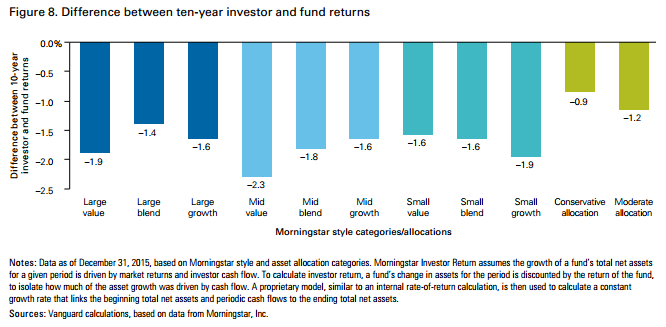

This is one of the reasons, investor returns in Morningstar trail fund returns. A recent article by Morgan Housel, You May Be A Better Investor Than You Think, discusses how average investors don’t earn anywhere close to a benchmark. The article uses the S&P 500 fund example and demonstrates how the 10 yr annual return is 6.3% while investor return is 4.4%. Even further many are unfairly comparing their portfolio to the S&P 500 only when their portfolio is diversified across multiple asset classes.

Below is a graph from a recent Vanguard study titled “Reframing investor choices: Right mindset, wrong market”, that demonstrates how behavioral performance chasing has a negative effect when investing across all asset classes.

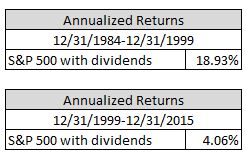

Past performance has a huge impact on the average investor’s decision making. This is demonstrated in every market bubble that’s existed from tulips in the 1600’s to technology stocks in the late 1990’s. Many of us remember this vividly, as the excitement around the S&P 500 peaked after investors experienced 15-20 years of earning double digit percentage returns every year in 1999 only to experience a much lower result in the next 15 years (ending 12/31/2015).

There are many studies that demonstrate how the average investor typically is penalized anywhere from 1.2% to 3% annually by making emotional decisions around their investments.

Requires Discipline

Even mutual fund managers experience poor investor returns at points. But the best ones, trust their research strategy and stick it out. Another study demonstrated that outperformance over the long term goes hand in hand with shorter periods of underperformance as 96% of 10 year outperforming mutual fund managers had at least one three year period when they underperformed, and 47% were actually in the bottom 10% over at least one three year period.

Average investors tend to throw in the towel at some point during that 3 year period of underperformance. This is when their FOMO or FOLIA takes control– the Fear of Missing Out or the Fear of Losing it All.

Learning how to manage these emotions and implement a disciplined process is the first step in minimizing average investor type behavior.

How Do You Avoid Being The Average Investor?

Avoid short-term temptations or reactions and focus long-term – Studies demonstrate the average individual stock could move 47% to -39% over the next year but that range shrinks to 7% to 17% annualized over a 20 year period. Many investors capitulate at the wrong time, resulting in a mistake that can be detrimental to their long-term picture.

Start with a plan – Implementing a savings strategy with a disciplined investment approach helps avoid ebbs and flows in short-run. By focusing on what you can control, the daily headlines become easier to digest.

Hire an advisor – This gives you a calming voice that can ease the uncertainty by providing historical perspective. There’s a reason even our financial advisors aren’t their own advisors. Finding an independent, objective fee-only financial advisor is a great step to helping you minimize average investor like thinking when it comes to your investments.