Being a young couple in our 20’s, my husband and I were not very concerned about saving for retirement like we should have been once we graduated from college. We thought we had plenty of time to save, but the truth is that it is better to start planning for your future sooner rather than later.

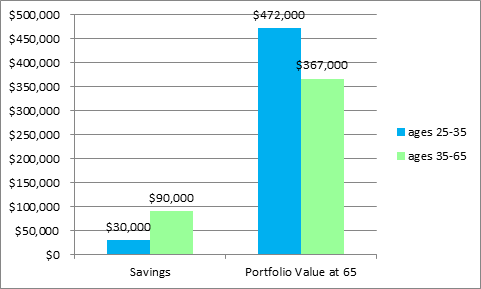

Here is a great example from CNN Money:

“Say you start at age 25, and put aside $3,000 a year in a tax-deferred retirement account for 10 years – and then you stop saving – completely. By the time you reach 65, your $30,000 investment will have grown to more than $472,000, (assuming an 8% annual return), even though you didn’t contribute a dime beyond age 35. Now let’s say you put off saving until you turn 35, and then save $3,000 a year for 30 years. By the time you reach 65, you will have set aside $90,000 of your own money, but it will grow to only about $367,000, assuming the same 8% annual return. That’s a huge difference.”

To get on the right track, the following are some changes we decided to make:

- We completed a financial plan.

- We began the investment management process.

- We contribute at least to the company match in our 401(k) and employer sponsored retirement plans.

- We fully fund our Roth IRAs after contributing to our employer sponsored retirement plans. In a Roth IRA the maximum contribution is $5,500 if you are under 50 years of age and $6,500 for those over 50 years of age.

No matter what your age is, it is important to save for retirement and be aware of where you stand financially.