Many of our new clients tell us they found out about fee only financial planning by listening to talk radio or watching their favorite financial pundit on television.

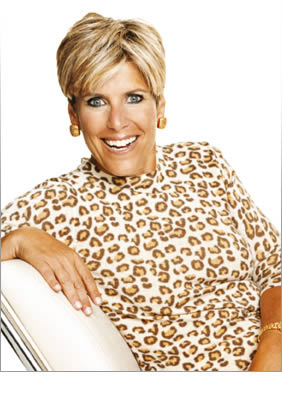

Media personalities such as Suze Orman, Clark Howard, and Dave Ramsey do a great service by inspiring consumers to take control of their financial lives. We also appreciate those who send clients our way by touting the benefits of fee-only financial planning.

While the work they do providing financial education and empowerment to the masses is terrific, there is one thing missing from their advice — YOU. Every once in a while we shock clients by recommending a different strategy than the hard and fast rules preached by these financial celebrities. This is because we take the time to get to know you, what your values are, and help you define your long term goals. We appreciate that every client is different and can benefit from planning and investment strategies that address their unique needs. Media personalities have to define systems intended to work for nearly everyone, so their methods tend to be extreme, from only using cash in envelopes for expenses to denying yourself purchases that may increase your quality of life.

Food for Thought

Sometimes the methods used by financial celebrities remind us of the health gurus on TV that come to your house and throw away all the food in your pantry or promote juice cleanses and no-carb diets. These measures may help you lose weight in the short term, but are not always realistic or appropriate for your specific needs. A few of the financial strategies we have recommended against are:

Pay Off Your Mortgage Early

Why wouldn’t you want to pay off your mortgage early? Interest costs alone over the life of a mortgage are huge when looked at in dollar terms. However, we typically don’t recommend neglecting contributions to your retirement accounts or emergency funds in order to pay off a mortgage early. Because for borrowers with good credit, mortgage rates are at historical lows, plus the interest payments are tax deductible. Therefore, the interest paid on your mortgage is likely to be lower than the rate of return earned on your investments over a 15 or 30 year period. While debt can be a four letter word, using debt responsibly as part of a coordinated strategy can help you achieve your long term goals.

Pay Cash For Everything

A sound concept with a goal of keeping you from living beyond your means. After all, if you can afford something, you shouldn’t need a credit card to pay for it. However, credit cards have made our financial lives easier by allowing us to visit the bank less frequently and carry less cash. Unless you have struggled with credit card debt in the past, we find that many people can handle the responsibility of spending reasonably with a credit card and paying off the balance every month. Typically only extreme cases warrant a cash only strategy.

Buy and Hold Only Index Funds

For average investors just starting out and doing it on their own, this is not bad advice. Your strategy can be boiled down to whether you believe in active or passive investing and cost. Index funds charge lower expense ratios than actively managed mutual funds. Therefore, if you believe that no one can beat the market, it is pointless to pay more for active management. We embrace a more active investment philosophy. So while acknowledging that everyone can’t beat the market, we believe there are talented managers who provide additional returns can be worth the extra cost. Another problem with this advice is that most investors can’t stick to a buy and hold strategy and tend to make portfolio changes based on short term market volatility and emotional biases. This leads to sub-par performance over time.