Is a financial advisor’s fee worth it?

Is a financial advisor’s fee worth it?

Couldn’t you do better job managing your own investments and avoiding that cost?

According to Vanguard, the leader in do-it-yourself (DIY) investing, they believe a financial advisor can add approximately three percentage points to a client’s investment returns per year. The study (link here) found five separate ways (below) advisors add value (alpha) in working with their clients.

| Vanguard Advisor's Alpha | Value-Add (approx. annual %) |

|---|---|

| Behavioral Coaching | 1.5% |

| Asset Location | 0 to .75% |

| Spending Strategy (withdrawal order) | 0 to .70% |

| Cost-Effective Implementation | .45% |

| Rebalancing | .35% |

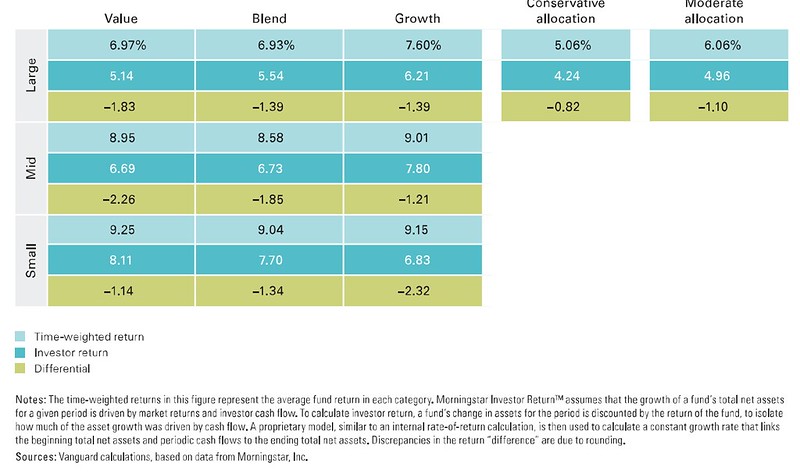

Behavioral Coaching (1.5%) – According to Vanguard the biggest deterrent to individual investor returns are, “the allure of market timing and temptation to chase performance.” Advisors help you stick to your investing plan in good times and in bad. This means not exiting the market during the credit crisis (Great Recession) or getting too excited during the tech bubble. Vanguard analyzed investor vs. fund returns in the chart below, and in every category the investor trailed the fund return due to poor market timing. Further analysis of this was completed in our Buy High, Sell Low blog post where we found the average investor trailed its fund by approximately 2.5% per year.

Asset Location (0 – .75%) – Did you know whether you place certain investments in taxable or tax-deferred accounts can have a material impact on your long-term after-tax returns? Optimal portfolio construction involves minimizing the impact of taxes by holding the right asset classes in taxable and tax-deferred accounts.

Spending Strategy (0 – .70%) – Do you have multiple tax-deferred (IRA, 401k, Roth IRA etc.) and taxable accounts? When you start withdrawing from these accounts the order and amount withdrawn from each account will have a significant impact on the total taxes paid during retirement. The wrong withdrawal strategy will reduce your wealth and the longevity of the portfolio.

Cost-Effective Implementation (.45%) – Studies have shown low-cost mutual funds outperform high-cost mutual funds over long time periods. By focusing on high quality, low-cost funds you increase your chance of success. This can be accomplished through low-cost active funds or index funds.

Rebalancing (.35%) – How often do you review your portfolio? To reduce risk it is important to rebalance/review your entire portfolio on a regular basis. It will be painful as it will require you to sell your winners and buy the losers, but over time this adds incremental return to the portfolio.

Asset Allocation

One other area that Vanguard concluded advisors add value, though it is too difficult to quantify, is Asset Allocation. This is the percentage of stocks, bonds and cash an investor holds, and it has a substantial impact to long-term returns. Unfortunately, each individual risk level is too unique for Vanguard to quantify the benefit an Advisor can add by the correct asset allocation. Many may argue it may be the most important factor to future returns. How do you determine your asset allocation?

These numbers only include investment performance and don’t include the other benefits advisors provide to clients including help with obtaining a mortgage, taxes, insurance, estate planning, etc. Morningstar did a separate study on “Gamma” that we have written about in the past. It also discussed the benefit and additional wealth of working with a financial advisor. Here is the link to that article.

If you are uncertain about the value of a financial advisor, Vanguard helps quantify it for you.

Our Take

we believe that without consistent reviews, a disciplined strategy, diligent research and accountability, our instincts will pull us in the wrong direction at the wrong times resulting in underperformance. Our goal is to help you to be in a position to avoid these crippling mistakes. After all, wouldn’t you rather end up with a higher probability of accomplishing the things you want to do instead of having to cut out things in retirement because you wanted to avoid paying the cost of an advisor.

Please contact us to discuss how we may be able to add value to your portfolio or schedule an appointment with a fee-only financial planner.

Connect With Us

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook