Over the last few weeks, we’ve had a few clients call us with some understandable concerns regarding current stock market conditions. They have asked whether it makes sense to sell stocks and move their money in to cash and bonds. Given the performance of stocks recently, and over the lost decade of the 2000’s, it is only natural to question the strategy of staying the course. Our experience has shown that these kinds of requests generally come right after the market has done poorly and, more importantly, right before it switches direction.

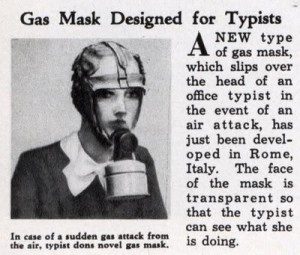

We spotted a story in the WSJ recently, which described how the Dow’s performance in May was the worst May since 1940. So we thought it might be helpful to take a trip back to the 1940’s and investigate what the general mood of investors might have looked like during that time. Most investor’s confidence in the stock market had to be incredibly shaken due to the erratic volatility at that time. The decade they had just lived through, the 1930’s, saw the Dow register eight calendar months in which it rose or fell by more than 20%. They also had to withstand three stock market drops of 30% or more (with the 1929 crash falling 89%) during that period. Now entering the 1940’s, a pervasive attitude of gloom had spread across our nation. Many of the messages in the media characterized the build-up of a country preparing for war.

Headlines and News of the 1940’s

- Germans invade Western Europe, France and Great Britain; London suffering bombing attacks daily for almost 2 months

- Unemployment drops but is still over 14%; “Union Closes Plant” 200 Men Reported Discharged by Boeing Company; Retaliation Suspected

- FDR signs legislation requiring US men Register for Draft

- Automobile Production Ceased in 1942 due to need for steel

War on the Horizon

It’s not a far stretch to say that people then were probably even more fearful about economic conditions than they are today. While fear continued to escalate, U.S. federal debt expanded rapidly, t- bills were near 0% and war savings bonds with a guaranteed 2.9% annual interest rate over 10 years became one of the more popular investments. However, the investors who were able to put aside their emotions and continue to invest in stocks fared much better. Dollars invested in the stock market from 1940-1949 averaged more than 9% per year over that decade. In fact, for the three decades beginning in January of 1941-1943, the annual returns were even stronger averaging in a range from 12% – 15.5%.

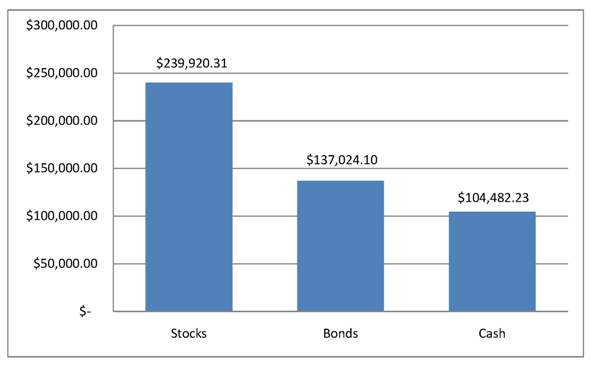

That means if you had invested $100K each in stocks, bonds and cash on January 1, 1940 and left it alone through December 31, 1949 your $100k would have grown to the following totals identified by asset class:

What You’ve Seen Often Isn’t What You Get

As the graph clearly shows the price you pay for safety in the short-term could likely be a costly one over the long-term. By many accounts, at the end of the 1940’s, Americans never had it so good. The war was over, jobs were plentiful, housing was affordable and the American Dream was in reach for more people than ever before. How truly valuable this knowledge could have been for an investor at the beginning of 1940.

For many investors in 2010, the strain of watching their investments swing on the roller coaster ride we’ve had since late 2007 has left them fatigued and ready to give up. However, as much as it goes against our psyche, a negative return for an entire decade is a powerful reason as to why we should be excited about the prospects for the next 10 years.